UPDATED: October 2022

How big is our annual budget?

The approved operating budget for fiscal year 2023 (FY23) is $310,932. We are starting the fiscal and program year with a projected surplus of $556. The fiscal and program year runs from July 1 to June 30.

Where does the money come from?

In FY22, 84% of the income came from the pledged giving of our members and friends, 6% from organizations that use our property throughout the year, 5% from regular givers who do not pledge, 4% from the church’s permanent fund, and 1% from loose offerings.

Where does the money go?

Approximately 53% of our budgeted expense is for salaries and benefits, 20% is for property and utilities, 13% is for direct program and operational expenses, 9% is for debt repayment of the mortgage, and 5% is for donations to local and world ministries.

We have one full-time employee, the Senior Minister, and six part-time employees, the Administrative Assistant, Education Coordinator, Music Ministry Intern, Sound Technician, Nursery Attendant, and Choir Consultant.

How did we do with the FY22 Operating Budget?

In FY22 total revenues were 105% of budget – more than $14,000 more than expected. Pledged giving was 103% over budget and non-pledged giving was 147% of budget. We attribute the increase to the return to in-person worship. Total expenses were in line with the budget at 99%. Worship expenses were three times greater than expected due to the hiring of a sound technician and costs associated with on-line materials. The FY23 operating budget has been adjusted accordingly.

What are the Church’s assets?

Our biggest financial asset is our 13,500-gross square foot building, originally built in 1960, its contents, and our five-acre property. As our neighborhood is being redeveloped with residential and commercial properties, we have continued to invest in our property. We have just completed a master plan for site improvements that will address pedestrian access, storm water management, and outdoor activities. In 2021 we completed a complete renovation of the kitchen and deacon’s room. In 2019 we replaced heating units in the classrooms, offices, and kitchen and added cooling to the kitchen. In 2014 we completed substantial interior renovations to the sanctuary, narthex, and restrooms and added a shower.

We maintain a Permanent Fund ($695,500) a Capital Projects Fund ($44,100), and three small, designated funds (totaling $38,500) invested with the Christian Church Foundation, the investment arm of the Christian Church (Disciples of Christ.) We also maintain a healthy balance in a cash operating account at a local bank. Fund and account values are as of June 30, 2022.

Some of the funds in the operating account are short term Special Funds. These are restricted amounts designated for specific purposes by the donors, such as the Blessings Box, the Bethany Beach retreat, Community Place Café, and Refugee Resettlement. There are also a Minister’s Discretionary Fund, a separate account used by the pastor to help individuals in urgent need and a separate, small Disciples Women’s account.

What are our liabilities?

The only substantial liability the church maintains is a mortgage stemming from a 2012 construction loan in the amount of $280,000 for major interior renovations. Currently, the principal plus interest payments on the mortgage are $2,300 per month. As of June 30, 2022, the outstanding balance is $136,411.

Deferred maintenance of capital assets is an ever-present concern. Facilities elements reaching the end of their useful life include roofs, windows, signs, and paving.

How is the annual operating budget developed?

Typically, the congregation holds an annual planning event each spring to evaluate current programs and identify new initiatives for the next year. The Board of Directors and members of the Finance Committee, a department within the Administration Division (Ministry), monitor income and expenditures throughout the year. Based on visions for the future, actual expenses, needs identified by the church’s five functional divisions (ministries), the results of the Stewardship Campaign, and projections of other income, the Finance Committee prepares a budget and submits it to the Board of Directors for Board and Congregational approval.

Who approves the budget and expenditures?

The Congregation approves the budget based on a recommendation from the Board of Directors at the Annual Congregational Budget Meeting to be held between May 15 and June 30 each year. The Board of Directors and staff approve expenditures throughout the year.

What Outreach causes does the congregation support?

University Christian Church is proud of its long history of significant giving to outreach causes both in the budget and in special offerings and gifts. For FY23 the total Outreach Budget is $23,200 including funds from the Operating Budget and from the Permanent Fund. The Congregation approves the allocation of the money to specific agencies or causes at the Annual Budget Congregational Meeting based on a recommendation from the Outreach Division (Ministry). A new recipient this year is the “More Than Enough” campaign of the Christian Church-Capital Area to support a full-time regional minister. Other FY23 recipients are:

- Disciples Mission Fund - supporting the leadership and witness of our denomination

- Community Place Café - a community feeding program for hungry neighbors

- Prince George’s Leadership Action Network (PLAN) - an ecumenical association of local congregations committed to engaging in public actions on issues of local concern

- United Campus Ministries - a Christian witness on the campus of the University of Maryland

- Prince George’s Plaza Day Center - providing lunch, laundry, and showers to homeless individuals two afternoons a week

- SAFE Center – providing support to victims of human trafficking

- Transmission Ministry Collective and Casa Ruby LGBTQ Community Center – supporting transgender persons

- Blessing Box and Help by Phone – providing food and supplies to those in need

- Safe Haven/Warm Nights - providing shelter to homeless people for weeks during winter months.

How does the Congregation raise funds?

Annual, pledged giving is the foundation of the operating budget and directly supports the vision of the congregation. The congregation conducts an annual Stewardship Campaign in the Spring, looking ahead to budget needs in the coming year and asking members and friends to make a formal “estimate of giving” or “pledge” of financial support for the next year. In addition, the church receives income from its investments with the Christian Church Foundation, special gifts and offerings, bequests, and fees from building users.

What is Legacy Builders?

Legacy Builders is a program recognizing individuals who have remembered the church in their end-of-life plans and shared that information with others. It was established in 2017. Over 20 individuals are currently participating. If you would like more information about Legacy Builders or making a bequest, please contact us.

How many people make annual pledges of giving?

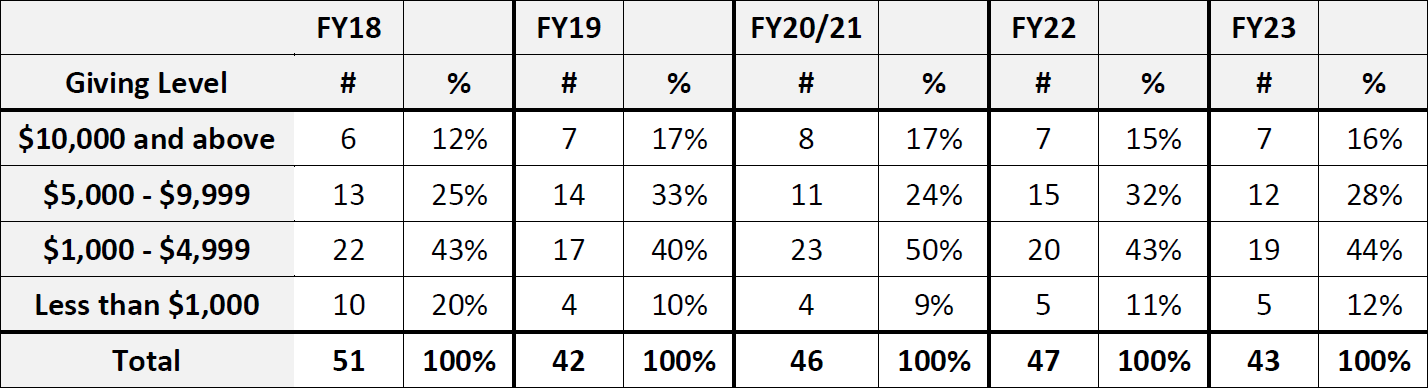

For FY23 we received 36 pledges and seven recurring donations on Easy Tithe for a total of 43 commitments. Pledges come from families, couples, and singles, both adults and children. The table below shows the number of pledges at various giving levels. The average number of annual commitments over the last five campaigns is 46.

How many people contribute regularly, but do not pledge?

In addition to those who made formal pledges, the Financial Secretary reports 17 givers expected to contribute approximately $24,000 to the general income of the congregation.

How much is a typical annual pledge or regular gift?

We encourage everyone to contribute to the shared work of our church through regular, generous gifts as their individual circumstances permit. The size of regular gifts varies considerably. The average commitment is $5,169.

What if my financial situation changes during the year?

Stewardship is a year-round effort and pledges may be submitted or modified at any time during the year. New pledges are always gratefully accepted. Estimates of giving can be adjusted (up or down) at any time by contacting the Financial Secretary, Sara Hindsley.

Historical Number and Percentage of Pledges By Giving Level:

What about Special Offerings and Gifts?

In addition to pledges and regular offerings, most contributors give separately to various Special Offerings throughout the year. The congregation participates in five denomination-wide offerings - Easter, Pentecost, Reconciliation, Thanksgiving, and Christmas, that support regional and national organizations. Approximately $3,505 was contributed during FY22 to these Special Offerings.

Contributors also give to various specific causes and activities such as Refugee Resettlement, Blessings Box, Bridge of Hope, Blanket Sunday, and Minister’s Discretionary Fund. In FY22 contributions to these and other special funds totaled $27,857, not including the Week of Compassion, the denomination’s disaster relief fund, which brought in $11,693. In addition, Disciples Women contributed over $6,000 to various causes.

What outside organizations use our facilities?

Prior to the pandemic, the following groups used our facilities and contributed to our operating costs: Congregations United for Compassion and Empowerment (CUCE) - Prince George’s Plaza Day Center; Impulse City, LLC; Children’s Rights Council; Music Together; University Park Women’s Club; Narcotics Anonymous; and a 12-step group. The Day Center and Impulse City have continued to offer services and programs under COVID protocols. As restrictions lift, we expect other building users to return. The building is also available at no, or low, fee for special events such as weddings, memorial services, baptisms, private parties, and community meetings.

What are the responsibilities of the Financial Secretary and the Treasurer?

The Financial Secretary receives contributions from members and friends each week, credits them to specific donors, deposits them in the bank, and distribute quarterly and annual giving statements. The Financial Secretary is appointed by the Board of Directors for an unlimited term. Sara Hindsley is our current Financial Secretary.

The Treasurer is elected by the Congregation for a two-year renewable term and serves as a member of the Board of Directors. This position is responsible for writing all the checks, paying all the bills, handling payroll and IRS requirements, and maintaining financial records. John Farley is our current Treasurer.

How does the Church manage its finances and investments?

In April 2017, the Board of Directors adopted a Financial Management and Investment Policy, replacing the previous 1993 Policy on Special Gifts. The Financial Management and Investment Policy consolidated the former Endowment and Memorial Funds into a single Permanent Fund, retained the Capital Reserves and Operating Funds, permitted the establishment of Specified Use Funds when needed, and established two management committees - an Investment Committee and a Permanent Funds Committee.

In September 2021, the Administration Division (Ministry) established Procedures for Handling Money to ensure the safety of offerings, accurate recordkeeping, and to uphold the integrity of those handling Church funds.

What does the Investment Committee do?

The Investment Committee is charged with reviewing investments and advising the Trustees on the allocation of funds. Members are appointed by the Trustees to serve staggered four-year terms.

What does the Permanent Funds Committee do?

The Permanent Funds Committee is charged with maintaining a list of acceptable projects in a variety of costs and to advise prospective donors on an appropriate gift as an alternative to a contribution to the Permanent Fund. Members are appointed by the President and ratified by the Board of Directors to serve two-year terms.

What happens to the income from the Permanent Fund?

Once a year, the Board of Directors may approve the amount of the income to be spent on ministry not to exceed 9.5% of the Permanent Fund. The policy designates that this amount be distributed among four recipients for purposes approved by the Board of Directors:

- 50% to the Capital Reserves Fund,

- 25% to the operating budget for a purpose(s) recommended by the Outreach Division Director,

- 15% to the operating budget for a purpose(s) recommended by the President-elect, and

- 10% to the operating budget for a purpose(s) recommended by the Senior Minister.

Are our financial records audited?

Our practice is to undertake a financial review every two years. We typically ask church members, experienced in business and management, but not directly involved in church administration, to conduct the reviews. To date, we have not hired a professional accounting firm to do a formal audit. Harriet Trupe completed a review of FY20 and FY21 financial statements and supporting documents in the Fall of 2021. She found no issues. A review of the FY22 and FY23 statements will be done the Fall of 2023.

What if I have other questions?

Please speak with the President of the Congregation Diana Brande, Treasurer John Farley, or Financial Secretary

Sara Hindsley.